Forás Capital is Ireland’s first search fund, established with the objective of acquiring a well-established company to lead, grow, and scale over the long term

Scroll down to learn more

Introduction

Sam Batran

Entrepreneur & Managing Director

Forás Capital

Hi there!

In partnership with a group of leading Irish, British, and international investors, we established Forás Capital, Ireland's first Search Fund. It is as an investment vehicle, which has the sole objective to identify, acquire and scale up only one well-established company. Post-acquisition, I will assume a full-time role as CEO, and my backers will be actively involved on the board. We have a depth of expertise in running, and growing companies.

We are the ideal buyers, if you are a business owner considering a transition, retirement, or an exit, while seeking continuity for the brand that you have built up. We will preserve your legacy, grow the company, and nurture the team. We aim to be your successors in business, while you seek your next chapter in life.

Selling your company does not need to be a challenging and difficult process. We are flexible and accommodating buyers. For instance, we can offer you a simple exit, or have you stay with us in our journey. Our long-term horizon ensures that the company stays true to its mission. We aim to invest in the business, and take care of the team, suppliers, and customers.

If you are thinking about selling your business, we are eager to connect.

Sam Batran

Entrepreneur & Managing Director

scroll down

Our Competitive Edge

Our objective is to build on your legacy, develop the team, and keep the business growing over the long term

We will preserve your legacy

Our goal is to grow the business & enhance the brand. We aim to be your successors & for you to continue feel proud of your company

We are human centric & care about your team

Our objective is to build on your current management team, and foster the culture that you worked very hard to build

We are flexible buyers & will accommodate you

We can offer you a simple full exit and/or have you stay on board as a co-investor, and accompany us in our journey

We are focused on one deal only with a long-term horizon

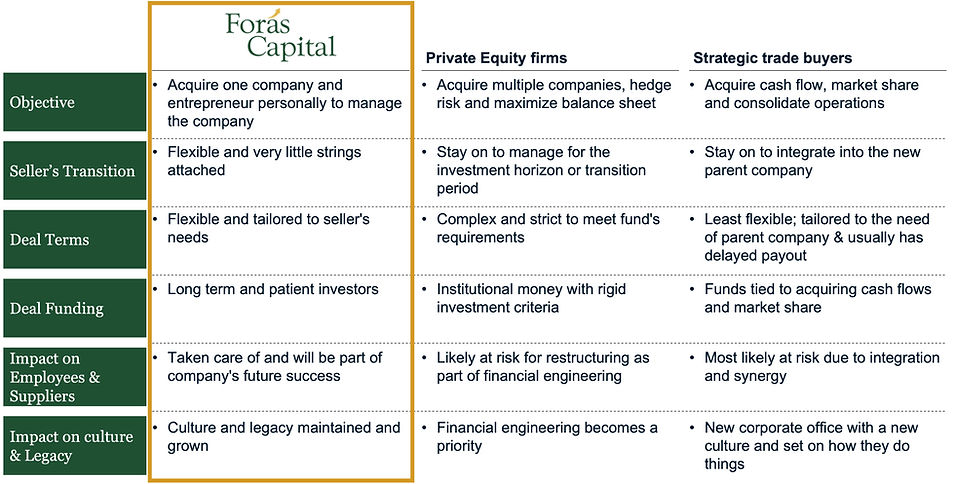

We are not a Private Equity or a strategic trade buyer. Our goal is to acquire one business, and grow it over the long term

We take over the burden of daily operation

We come in with a full-time CEO & active board, rolling-up our sleeves, and taking a hands-on approach, allowing you to move on

We are experienced investors with a track record

We don’t only have deep pockets, but also a wealth of experience in leading, operating and scaling up companies

scroll down

Unlike other buyers, we provide you a succession plan with flexible and tailored terms

scroll down

Our Investment Focus

We are looking to acquire an existing and successful business in full or a substantial majority

Already successful business and growing

-

History of profitability & growth

-

Healthy margins

-

Revenues between €7-50M

High quality of revenues and high potential for growth

-

Limited capital expenditure to grow

-

Recurring revenues

-

Diversified client base

Compatibility of philosophy, vision, and the way forward

-

Good rapport between both sides

-

Alignment of ethics, values, and the future of the business

-

Seeking a 100% exit or willing to stay with a 10-20% stake

The above criteria are just guidelines, and we will evaluate each business on a case by case basis. We understand and appreciate that each company has its own characteristics and industry dynamics.

scroll down

The Process

We offer a flexible and personalized process that aims to achieve a win-win outcome for all stakeholders

Step 1: Initial Conversation

-

Introductory meeting to get to know each other.

-

To learn more about the business, its current ownership situation, and structure.

-

To share the background of Sam Batran and his backers.

-

If both stakeholders are happy to proceed, Forás Capital is willing to sign an NDA to confidentially receive additional information.

Step 2: High Level Analysis

-

To preliminarily understand the business based on data shared.

-

To discuss growth drivers, market dynamics and sector.

-

To go over the status of the team, suppliers and key customers.

Step 3: Agreement on Price and high level terms

-

To sign an LOI (Letter of Intent).

-

To clarify the valuation of the business.

-

To agree on a timeline to complete the transaction and transition period.

Step 4: Due Diligence

-

To complete a due diligence exercise, typically — but not limited to — financial and legal.

-

To gain a deep understanding of the business.

-

To build a detailed business plan on the way forward.

Step 5: Deal Closure

-

To sign the required documentation.

-

To transfer the ownership of the business.

-

To release the funds to the sellers.